Tired Of Losing Money In The Stock Market? You’re Not Alone!

With the current stock market woes, most investors have seen the value of their retirement and stock market portfolios drop by 30% or more. And according to almost every news story – it’ll take years to get even a portion of these funds back.

That’s why many people are now considering buying real estate in their IRA or retirement plan as a great way to recoup their losses – and protect their future retirement funds!

Here Are Four Reasons Why Using IRA / Retirement Plan Funds To Purchase Real Estate Makes Sense:

- The stock market has tanked, and investors have lost confidence! Almost everyone’s stock market portfolio is down 30% or more. Buying real estate just makes sense.

- Real estate prices are dramatically lower than just two years ago, creating tremendous upside through both a higher future resale value and the rent you collect in the interim!

- There is a tremendous amount of foreclosures and auctions where you can pick up beautiful homes for 20% or less of their value!

- Growth and profit is tax-free! Because the home is in a qualified retirement plan, you can buy a home today, then sell it in three years for $300,000 profit – and not pay taxes on the profit! Instead, you can use the full profit to buy even more properties!

How To Use Retirement Plan Funds To Purchase Real Estate

Buying real estate in an IRA or retirement plan is not new; commonly called a Self-Directed IRA, it has been an option since the passing of the Employee Retirement Income Security Act (ERISA) in 1974.

And you’re not alone if you are one of many investors who are not familiar with the Self-Directed IRA concept, as it simply isn’t pitched – or supported – by brokerage firms who would rather sell you stocks and bonds over and over again for multiple or ongoing investment fees instead of the one-time fee for buying a property.

Types Of Retirement Accounts That Can Be Moved Into Self-Directed IRA Accounts:

- Traditional IRA’s

- 401(k)s

- Keoghs

- SEP IRAs

- Roth IRAs

- Profit Sharing Plans

- Qualified Annuities

- Deferred Compensation Plans

- Coverdell Education Savings (ESAs) a.k.a. Educational IRAs

By purchasing real estate in your IRA or retirement plan, you are not changing what your retirement plan funds do (building tax-free value for use at some future date); you are simply changing the type of investment in your retirement account (from stocks, bonds, and mutual funds to real estate) to reap the benefits of appreciation and rental income, as explained below.

Benefits Of Purchasing Real Estate In Your Retirement Plan

Your money grows three ways while owning real estate in your retirement plan:

- Through the increase of the value of the home appreciation

- Through the accumulation of rental income

- Through TAX-FREE growth accorded to retirement plans (yes, this means you can sell a home at a $500,000 profit and not pay taxes on it!)

Below is an example of how a $200,000 home can grow to $500,000 or more using historical averages (disclaimer: past performance is not an indicator of future performance):

Example: Purchase Price Of $200,000

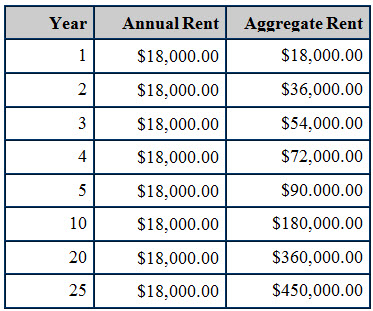

Example: Rental Income, $1,500 per month (no rent increase)

Of course, you’ll have to pay your taxes and any improvements you make to the home, but even with these costs, the bottom line of what you keep is still pretty substantial – and even more so when you realize the growth is tax-free!

How To Get Started

There are a couple of technical requirements that allow you to purchase real estate in an IRA or retirement plan. Included below are some of the basics, but investors are strongly recommended to do their full research regarding the applicability such investments.

Some Basic Requirements:

- Purchasing real estate in an IRA is allowable under the ERISA Act of 1974.

- Purchasers have to have a separate investment account with the required documentation, plus abide by a few simple rules; namely, that funds in this account cannot be commingled with other funds. In other words, you can’t pay for improvements with your personal money, and rent must be deposited into this account. Doing so voids the tax-free benefits of your IRA.

- Most brokerage houses do not support – and therefore allow – investors to hold real estate in an IRA. Therefore, individuals purchasing real estate in their IRAs must use an approved provider for both their account set-up and documentation. (We have included a list of those vendors below.)

Note: it generally takes two to four weeks to set up the required account, transfer/close out an old IRA, and get the funds into the new account. This corresponds to the 30 or so days it takes to “close” on the property, but don’t dawdle on getting your SDIRA account set up, as the new property must be titled and paid for with your SDIRA account and not personal funds.

Getting Started:

We recommend the following steps for getting started with purchasing real estate in an IRA or retirement plan:

- Read and Research. Make sure you understand the rules and requirements of a Self-Directed IRA. You’ll have to set up your account with a qualified administrator, not commingle funds, and abide by a few other rules.

- Decide On A “CheckBook” or “Regular” Self-Directed Account. Some qualified administrators require you to mail invoices to them for processing, while others provide a checkbook set up whereby you pay your own invoices. Make sure you know the benefits of both. Some recommended administrators appear below.

- Know Your Personal Temperment. You’ll not only have to spend time selecting and closing on properties, but depending on how many you purchase and for what reason, may want to rent out your new homes. Make sure you know your requirements and capabilities.

- Find The Right Properties. Don’t just buy houses because they are cheap. Make sure you have a plan as to where you want to buy, why you want to buy there, and whether or not you will rent the properties. Use your real estate agent for guidance.

Recommended Administrators

Your self-directed account must be properly set up and maintained by a qualified administrator. Here is a list of some of the leading administrators:

- www.MyRealEstateIRA.com – Do research / Request more info

- www.GuidantFinancial.com – To have info sent to you & To read more / do your own research

A Final Word

The information provided herein is for informational purposes only and should not be construed as investment advice.

We do, however, hope the information is helpful and thought-provoking, and provides you with an incentive to investigate whether purchasing real estate in an IRA or retirement plan works for you!